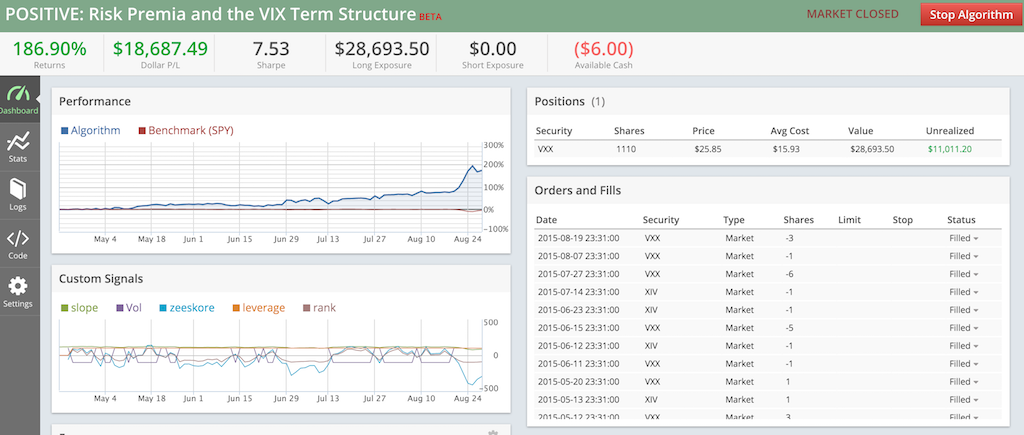

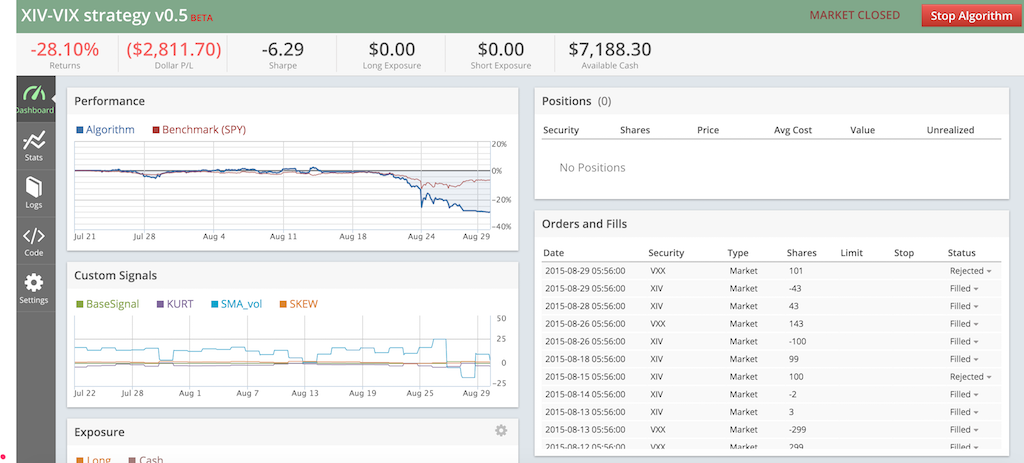

I trade a few algorithms with hard earned cash and the last week I could see the power of a good algo: a few were able to jump out of the market (damage control) and a few destroyed cash (a volatility algo that made money for marketmakers but not for me) and one made a shitload of cash. So I decided to share the one that made money as I'm sure I'm on to something but it's not perfect yet. Anyone else has some rough gem to share we can learn from? Do you see improvements in this algo?

Cheers, Peter