Maybe someone can code an algo for this notion.

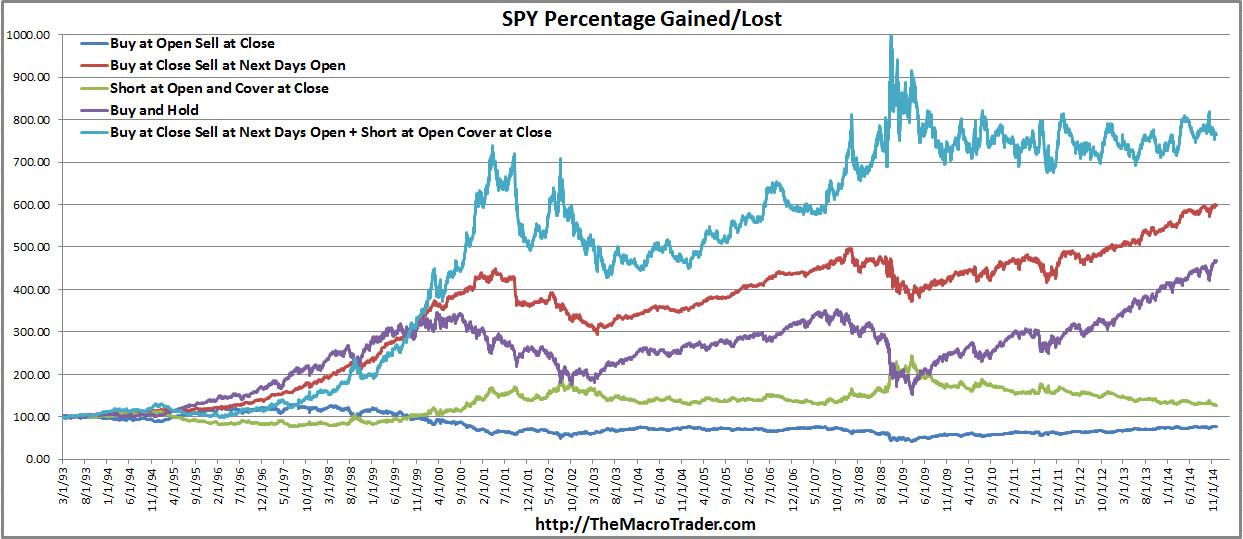

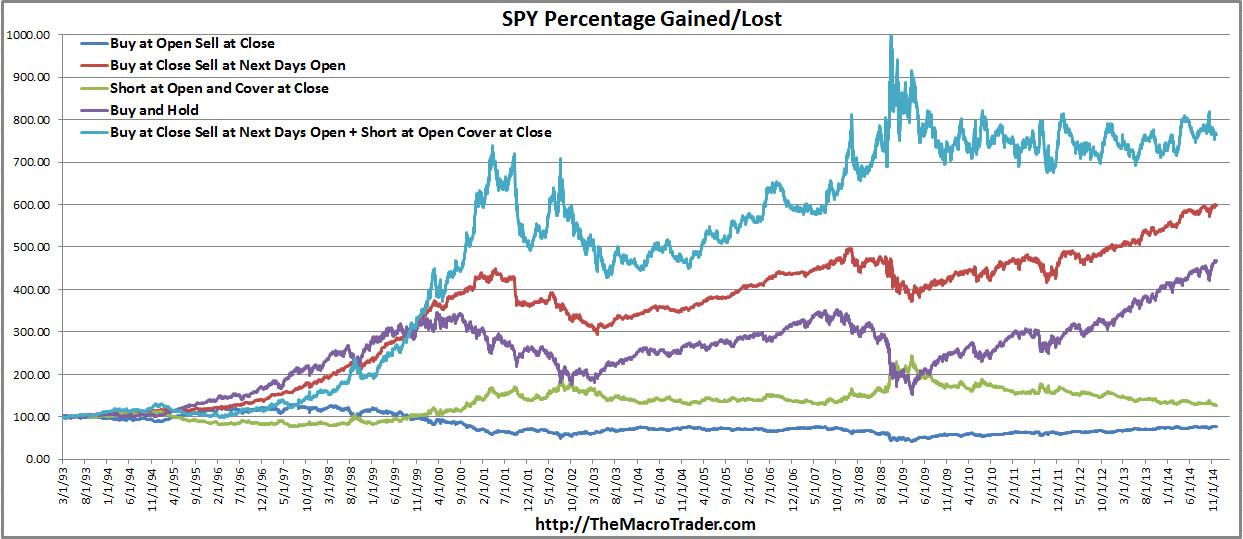

The article (if you can call it that) at InvestmentWatchBlog doesn't have much content, then there's a link to a twitter message with the image below ...

Maybe someone can code an algo for this notion.

The article (if you can call it that) at InvestmentWatchBlog doesn't have much content, then there's a link to a twitter message with the image below ...

Hey Gary,

This is my attempt at an algorithm for the 'long during nights and short during day' strategy.

Commissions and slippage are set to zero.

Note that presently, all Quantopian orders are cancelled at market close under live trading, per the help page:

All open orders are cancelled at end-of-day.

Orders made in the last minute of the trading day will be automatically cancelled.

Presumably, this behavior will change at some point, and overnight orders will be supported.

Note also that the Quantopian backtester will use minutely closing prices for filling orders, so you need a custom slippage model to capture the true daily open.

I did some yahoo data manipulating and come up with the same results as the chart above, pretty interesting. Even in recent years overnight has outperformed intraday, but intraday returns have gotten better.

This test is sorta interesting, it looks at the price change since around mid-day and makes an overnight bet in the opposite direction. I was not expecting it to perform at all, but it did okay. I think these sorts of things are more of a novelty than anything else though because trading fees would eat them alive.